Revolut’s foray into the crypto market signals a significant shift in digital banking, offering a blend of traditional banking and crypto trading within a single platform. This review will critically assess Revolut’s crypto offerings, examining their suitability for different types of users and comparing them to traditional cryptocurrency exchanges.

This article is all about Revolut. Check out this next one if you’re interested in seeing some other crypto friendly banking apps based in the UK.

Introduction to Revolut’s Cryptocurrency Features

Revolut’s integration of cryptocurrency trading into its platform in 2017 has positioned it uniquely in the fintech sector. Offering over 120 cryptocurrencies, it provides users with a straightforward way to engage with the digital currency market, expanding the scope of traditional mobile banking.

The Emergence of Revolut in the Crypto Arena

Revolut’s venture into crypto services was a strategic move to meet the growing demand for digital currency accessibility. This expansion diversified its service offerings, attracting a new wave of users interested in the burgeoning crypto market.

Overview of Revolut Crypto Services

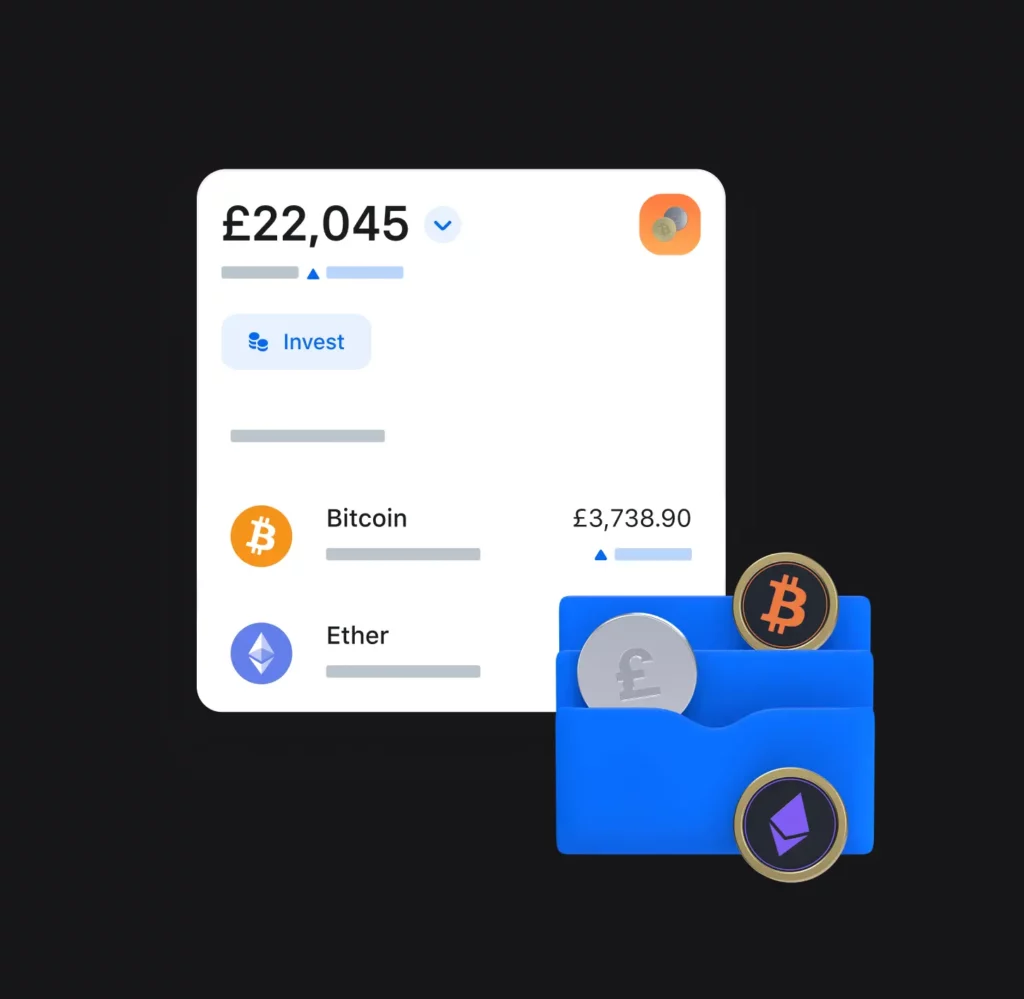

Revolut’s crypto services enable users to execute basic crypto transactions like buying, selling, and holding within its app, streamlining the process for users who might be new to digital currencies or prefer an all-in-one financial app.

Analyzing the Functionality of Revolut Crypto

Revolut’s approach to cryptocurrency is designed to provide ease of use for its customers. However, understanding the limitations and capabilities of its crypto services is crucial for users looking to make informed decisions about their digital currency investments.

Revolut Crypto’s Buying and Selling Functionality

Revolut’s cryptocurrency service simplifies the buying and selling of digital currencies, offering a user-friendly interface that appeals to both beginners and those seeking a quick transaction process.

Buying and Selling Cryptocurrencies on Revolut

Revolut’s cryptocurrency trading feature is streamlined to offer a straightforward experience for users. This service is especially attractive to those who prefer a simple, no-frills approach to buying and selling digital currencies. Revolut’s platform integrates these features into its broader banking app, providing a seamless transition between managing fiat and digital currencies.

List of Supported Cryptocurrencies

Revolut provides access to a wide range of cryptocurrencies, exceeding 120 options including popular ones like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), along with various altcoins. This extensive selection caters to diverse investor interests, allowing users to explore and invest in a variety of digital assets. The platform’s continual update of its cryptocurrency offerings ensures that users have access to the latest and most demanded digital currencies in the market.

Understanding Revolut’s Crypto Exchange Process

The process of buying and selling crypto on Revolut is designed for ease of use. Users can select their desired cryptocurrency, enter the amount they wish to trade, and execute the transaction with just a few taps. The app displays the transaction cost in the user’s local currency, ensuring transparency. However, it’s important to note that Revolut sets its own crypto exchange rates, which may differ from market rates. This aspect is crucial for users to consider when evaluating the financial implications of trading on the platform.

Limitations of Crypto Transactions on Revolut

While Revolut’s crypto services are user-friendly, they come with certain limitations that affect how users can interact with their digital assets. Understanding these restrictions is crucial for users to make informed decisions about their crypto investments on the Revolut platform.

Restrictions on Crypto Transfers to External Wallets

A significant limitation of Revolut’s crypto service is the inability to transfer most cryptocurrencies to external wallets, with the exception of Bitcoin (BTC) and Ethereum (ETH). This restriction means that users cannot move their crypto assets outside of the Revolut ecosystem, except for these two currencies. This limitation poses a challenge for users looking to manage their crypto holdings across different platforms or seeking full control over their digital assets.

Implications of Revolut’s Closed Ecosystem

Being locked into Revolut’s ecosystem limits users’ flexibility in managing their crypto investments. The inability to transfer crypto assets to external wallets means that users must rely solely on Revolut’s platform for all their crypto transactions. This constraint affects users’ ability to capitalize on potentially better rates or services offered by other exchanges or wallets. Additionally, if a user decides to stop using Revolut, they are forced to liquidate their crypto holdings within the app, potentially at less favorable rates.

Evaluating Revolut’s Crypto Fees and Costs

Understanding the fee structure for Revolut’s crypto services is crucial for users to make informed decisions. The platform’s fees vary based on the type of account and the nature of the transaction.

Fee Structure for Standard and Plus Account Users

Revolut’s fee structure for Standard and Plus account users is an essential aspect to consider. These fees can impact the overall cost-effectiveness of trading cryptocurrencies on the platform, especially for frequent traders or those dealing with larger sums.

Analysis of Percentage-based and Minimum Fees

For Standard and Plus account holders, Revolut charges a percentage-based fee of 1.49% for each crypto transaction, with a minimum fee that depends on the user’s region. This fee structure means that every buy and sell transaction incurs a cost, which can accumulate, especially for frequent traders. This aspect is vital for users to consider, as it impacts the overall cost-effectiveness of using Revolut for crypto transactions.

Additional Charges for High-Volume Transactions

Users who exceed £1000 in monthly currency exchange transactions face an additional 0.5% fee on their cryptocurrency purchases or sales. This additional charge can significantly increase the cost for active users who engage in high-volume trading, making Revolut less attractive compared to platforms with lower or fixed fee structures.

Fees for Premium and Metal Account Users

For Premium and Metal account users, Revolut offers a different fee structure, which is more favorable compared to Standard and Plus accounts. This tiered fee system reflects the platform’s approach to catering to a diverse user base with varying needs and investment volumes.

Comparison of Fee Structures Across Account Types

Premium and Metal account users benefit from a reduced percentage-based fee of 0.99% per crypto transaction. This lower fee makes Revolut’s Premium and Metal plans more appealing for users who engage in frequent or high-value crypto transactions. However, even with this reduced fee, it’s important for users to weigh the overall costs against the benefits offered by these account types.

Understanding Stablecoin Exchange Fees

Unique to Revolut is the absence of a crypto fee for exchanges between fiat currency and stablecoins like USDC or USDT, although other fees may apply. This feature offers an advantage for users interested in stablecoin transactions, potentially making Revolut a more attractive option for this specific use case.

Revolut Crypto Wallet: Features and Limitations

Revolut’s approach to cryptocurrency storage differs from traditional crypto wallets, presenting both unique features and certain limitations.

The Structure of Revolut’s In-App Crypto Wallet

Revolut’s approach to cryptocurrency storage is unique and differs significantly from traditional crypto wallets. This section will explore the features and limitations of Revolut’s in-app crypto wallet, which plays a key role in how users interact with their digital currencies on the platform.

How Revolut Manages User Cryptocurrencies

Revolut’s crypto wallet operates within its app, where cryptocurrencies are stored in a pooled virtual account rather than individual wallets. This structure means that while users can see their holdings and their value, they don’t have direct control over their private keys. This setup offers ease of use but limits the user’s ability to manage their crypto assets independently.

Limitations in Crypto Withdrawals and Spending

The primary limitation of Revolut’s crypto wallet is the restriction on transferring cryptocurrencies to external wallets, with the exception of Bitcoin and Ethereum. These limits on withdrawals and the inability to use cryptocurrencies for payments using the Revolut card significantly reduce the utility of holding digital currencies on this platform, especially for those seeking broader use of their crypto assets.

H2: Comparing Revolut with Other Cryptocurrency Platforms

While Revolut offers a streamlined approach to cryptocurrency trading, it’s essential to compare its services with other platforms to understand its position in the broader crypto market.

H3: Revolut vs. Traditional Cryptocurrency Exchanges

Understanding how Revolut’s crypto services compare with traditional cryptocurrency exchanges is crucial for users considering the platform for their digital currency transactions. This comparison will highlight the strengths and weaknesses of Revolut in the broader context of the crypto market.

Subsection: Advantages and Disadvantages of Using Revolut for Crypto

Revolut’s primary advantage lies in its integration with digital banking, offering a convenient way to manage both fiat and digital currencies. However, its limitations in crypto transfers, wallet functionality, and higher fees compared to dedicated crypto exchanges make it less appealing for more experienced crypto users or those seeking comprehensive crypto services.

Subsection: Alternative Platforms for Crypto Transactions

Alternative platforms like CryptoWallet.com offer more extensive crypto services, including the ability to spend cryptocurrencies using a crypto card and support for a wider range of digital currencies. These platforms often provide more competitive fees and greater flexibility in managing crypto assets, making them suitable for users seeking a more comprehensive crypto experience.

Conclusion: Assessing Revolut as a Crypto Platform

In concluding this review, we assess Revolut’s viability as a crypto platform, weighing its features against its limitations and fees.

Final Verdict on Revolut’s Crypto Services

Revolut offers a convenient entry point into the world of cryptocurrencies, particularly for those already using its banking services. However, its limitations in terms of crypto transfers, wallet control, and higher fees compared to specialized crypto exchanges make it less suitable for advanced users or those seeking comprehensive crypto management capabilities.

Recommendations for Potential and Current Revolut Users

For users primarily interested in casual crypto trading without the need for advanced features, Revolut’s platform is a viable option. However, those seeking more control over their crypto assets, lower transaction fees, and broader functionality should consider dedicated cryptocurrency exchanges or platforms that offer more flexibility and comprehensive crypto services.